Financing – the last major step in the sale/takeover process

The buyer has made the decision to purchase the shares in your company and the signing of the protocol has been scheduled to take place: now comes the practical financing phase. Let's talk to Banque de Luxembourg expert Charles Sunnen, Corporate and Liberal Professions Adviser, about the options available to the buyer at this key stage.

What are the different sale/takeover options when it comes to a transfer?

There are a number of different transfer scenarios, but the most common ones involve one or more heirs, more distant family members, managers and/or employees of the company who wish to invest – often so that they can keep their tools of the trade – third-party investors who work in the same sector as the company being transferred or who see the buyout as an opportunity...

Sometimes it is a mix of people from both inside and outside the company. A shareholder restructuring will therefore be necessary. New buyers may decide to consolidate the shareholder base by buying out minority shareholders – these may be family members who do not have, or no longer have, the same vision for the company in the medium or long term. In other cases, the seller will have to act in the interests of the company, i.e. favouring external growth at the expense of the family. This will enable the company to conquer other markets and acquire additional expertise by developing new or related business…

Is there a solution to finance the transfer of a business?

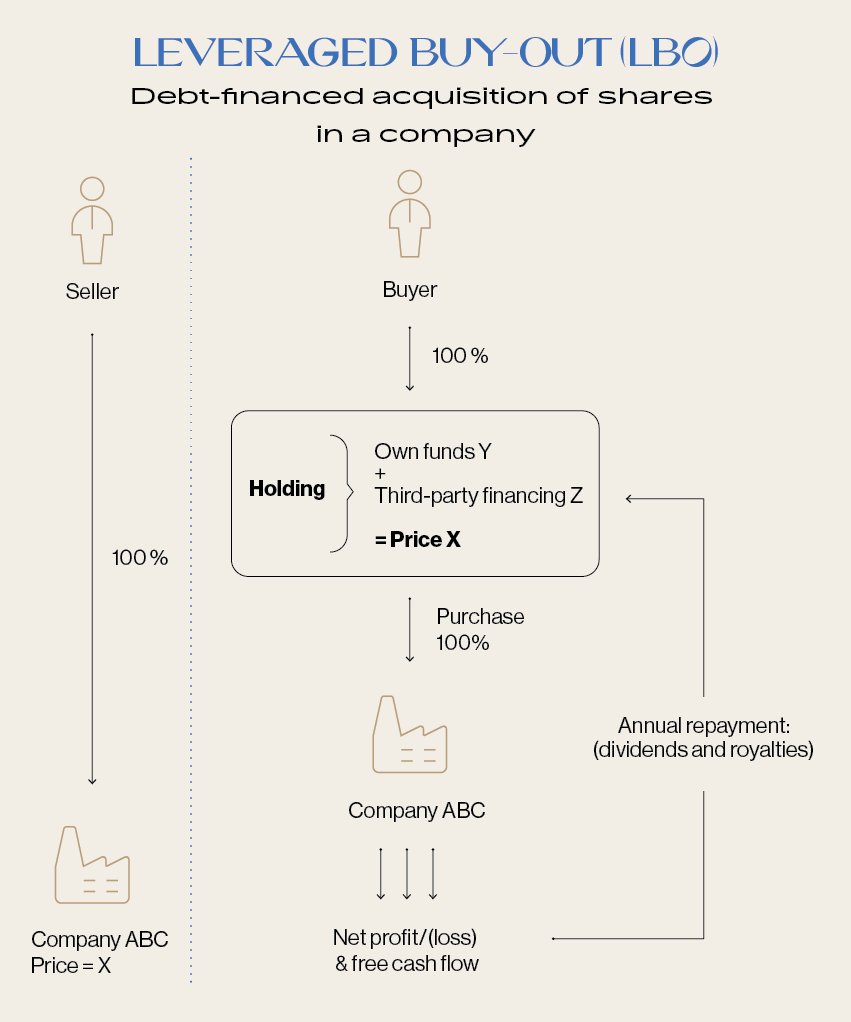

Yes: a leveraged buy-out (LBO) is the most commonly utilised form of transaction. This is a financial arrangement that enables the new buyer to purchase the seller's business by creating a holding company. Trustees, consultants, facilitators, lawyers... – the players involved in an LBO are diverse and complementary.

What forms can financing take?

How does Banque de Luxembourg approach the issue of financing?

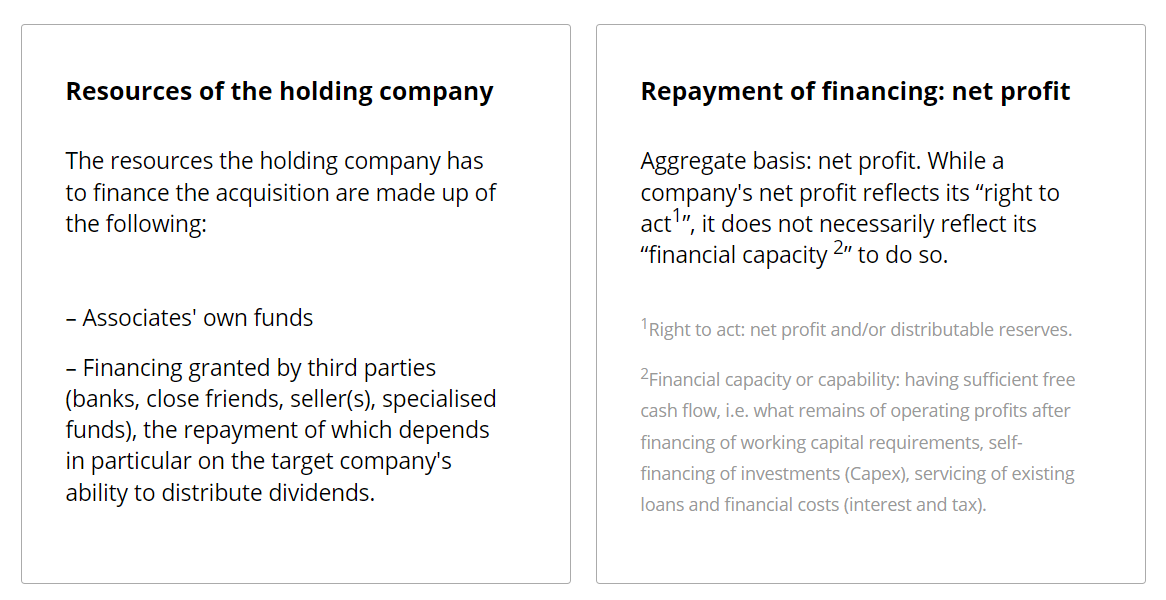

Often, and of course depending on the various elements of the takeover project (such as the purchase price), a bank loan will tend not to exceed 70% of the purchase price. Financing can be provided with the help of the SNCI (Société Nationale de Crédit et d'Investissement) via its indirect development-redemption loan.

Generally speaking, the term of a bank loan for acquiring shares in a company will not be more than seven years. It is therefore essential for the company to be able to generate profits and future cash flows that will enable dividends to be paid to the holding company in order to repay the debt. Financing a business takeover is a complex process that requires careful planning and extensive expertise. Determining the purchase price, rigorously analysing repayment capacity and putting in place adequate guarantees are all necessary elements when it comes to ensuring its viability.

Banque de Luxembourg has proven expertise in the structuring of financing and provides entrepreneurs with tailored support through every stage of the transfer process. We strongly encourage entrepreneurs to prepare for the transfer of their business with the help of qualified professionals who can deliver a structured approach, ensuring a smooth and prosperous transition for the future of the business.

First, please LoginComment After ~