Bolivia's Lithium Resources Luring Mainland and Hong Kong Entrepreneurs

As Hong Kong and mainland businesses continue to proactively scout out new business opportunities in markets they have typically been less active in, Latin America is one region to have attracted particular interest. In addition to a variety of well regarded food and beverage offerings – notably beef and wine – there has also been an uptick in awareness of the region's mineral wealth. This has been apparent in the case of both Hong Kong entrepreneurs and their mainland counterparts.

In January 2024, for instance, the Chinese consortium CBC, which includes battery giant CATL, increased its stake in Bolivia's lithium mining sector by signing new agreements with the country's state owned lithium company YLB.

The deals will see CBC invest US$2.3 billion (HK$17.9 billion) into Bolivia's lithium industry and develop a pilot plant with an initial production capacity of 2,500 metric tons of the metal per year. The plan is to increase this in the future to an ambitious 25,000 metric tons.

Federico Davia is an electrochemistry PhD researcher in Argentina who specialises in lithium battery applications. Expressing confidence in CBC's ability to achieve this target, Davia said: “Transitioning from exploration to actual production at a brine source typically takes around seven years.

“The CBC consortium has a deep understanding of the brine's chemistry from its experience in processing it. It's putting in sufficient investment and could probably complete the transition within five to eight years given its capabilities.”

LatAm's ‘Lithium Triangle’

It is generally accepted that rare earths and minerals used in batteries, green technologies and other applications are set to drive the global economy in the 21st century. According to the American federal agency, the US Geological Survey, more than half of the world's identified lithium resources are located within Latin America.

Most are concentrated in the so called Lithium Triangle, which spans parts of Argentina, Bolivia and Chile. It is thought that Bolivia alone is home to more than 21 million metric tons of lithium, most lying beneath the vast Salar de Uyuni salt flats.

According to Davia, extracting lithium from the brine resources that dominate the Lithium Triangle region is significantly cheaper than traditional hard rock mining methods used, for example, in Australia.

However, he explained that chemically extracting lithium from the latter process has other advantages, saying: “Given the fact that its chemical processes are simple and well established, traditional hard rock mining allows for a significant increase in production within months, which is highly valuable given the current volatility in lithium prices on the global market.”

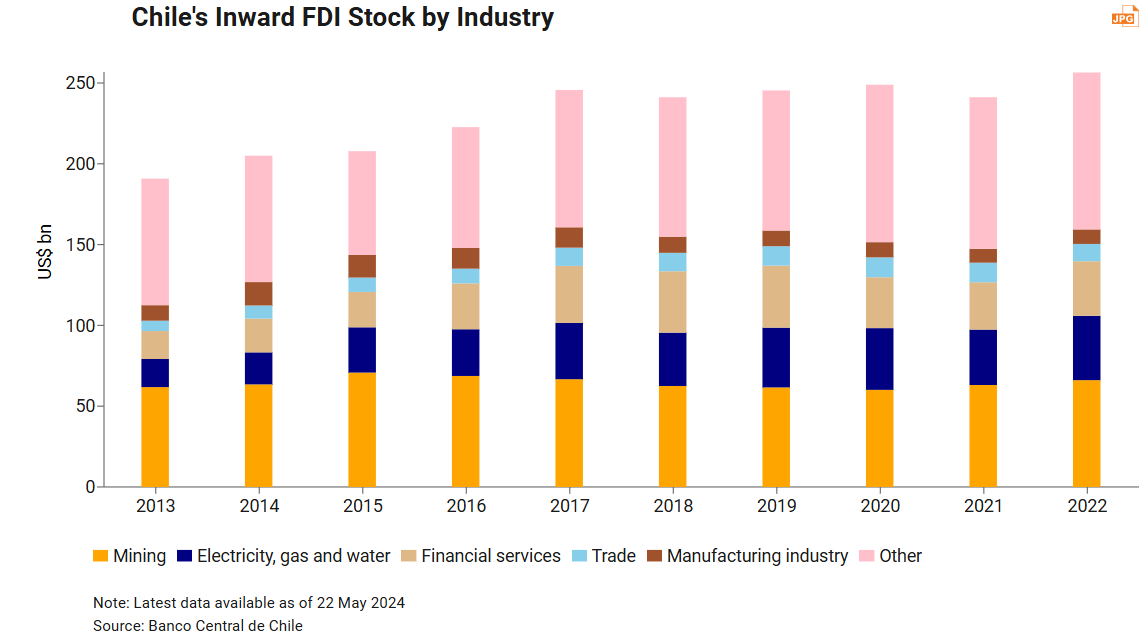

Davia noted that, among Latin America's lithium rich countries, Argentina and Chile have already built strong positions in the industry. This, he said, is mainly due to their large reserves of the metal, their technical expertise in extraction and processing, and their extensive exploration activities.

Maintaining that sustaining such market leadership without outside help will prove challenging, Davia said: “With projected long term demand, even expanding production to the maximum extent possible may not be enough. The chemical nature of extracting lithium from brine means increases in scale cannot happen rapidly enough to keep up with rising demand.”

Bolivia seeks international partnerships

In contrast with its neighbours, Bolivia has so far struggled to industrialise its lithium sector. Ross O’Brien is Analyst in Chief for data consultants Delta Analysis, with a focus on renewable energy and technology. Outlining the country's desire to move up the lithium value chain, he said: “They don't want to just export raw materials – they want to participate in and capture value from the processing and production of battery components. It is, however, a highly ambitious goal as, currently, Bolivia is just a source of the raw material.”

According to O’Brien, developing robust lithium industries and expanding production capacity in Bolivia will involve huge complex challenges – from building financial, technical and regulatory frameworks to establishing logistical supply chain management systems. In line with that, he said it made sense that Bolivia is looking to attract more international partnerships – such as that with CBC – to help overcome such obstacles.

Asserting that Bolivia’s strategy of forming collaborative partnerships is the way forward, O’Brien said: “It can help enhance the region’s role in global lithium supply chains and directly benefit the local economy. This can foster more stable, long term relationships.”

Ultimately, partnering with experienced Asian companies could facilitate Bolivia's efforts to scale up lithium extraction and processing sustainably. This particular deal, which comes at no cost to the Bolivian government, will involve the underwriting of pilot projects and feasibility studies for a proposed lithium carbonate industrial complex led by YLB in partnership with CBC.

Role for Hong Kong

While China scrambles to secure strategic resources and technologies overseas, O’Brien believes that Hong Kong also has the potential to play a role in developing Latin America’s lithium resources.

Outlining Hong Kong’s advantages as a bridge between China and the region, O’Brien said: “Hong Kong has increasingly positioned itself as a platform to facilitate green infrastructure and clean energy investments globally. It can help link China’s financial capital and industrial skills with opportunities that exist in Latin America.”

O’Brien also noted that Hong Kong, an offshore hub with strong international connections, could help bring in a wealth of scientific and institutional expertise that may benefit collaborative partnerships in this sector. The city has also cultivated a robust research community focused on emerging technologies.

Summarising how he believes Hong Kong can participate in the development of lithium in Latin America, O’Brien said: “For lithium extraction, processing and battery manufacturing industries, Hong Kong based partnerships could help provide the capital, technical knowledge and logistical support networks needed.”

All views expressed in the Market News section reflect those of the individual correspondent and any interviewees. They are neither endorsed nor verified by the HKTDCand UDFSpace.

First, please LoginComment After ~