Latin America: Harnessing the Power of Foreign Investment in Chile

Chile, thanks to its pro-business environment and supportive government schemes, has become one of the leading FDI destinations in Latin America, a development that has seen it established as home to an increasingly vibrant start‑up scene. To better understand its investment environment and start‑up landscape, HKTDC Research undertook a consultative visit and engaged with a variety of local businesses and trade associations.

A business haven

Chile has a reliable institutional system governed by the rule of law, as well as a longstanding commitment to free‑market policies. This has resulted in a favourable business environment for both local and foreign investors, while also seeing the country highly ranked across a range of international economic indicators.

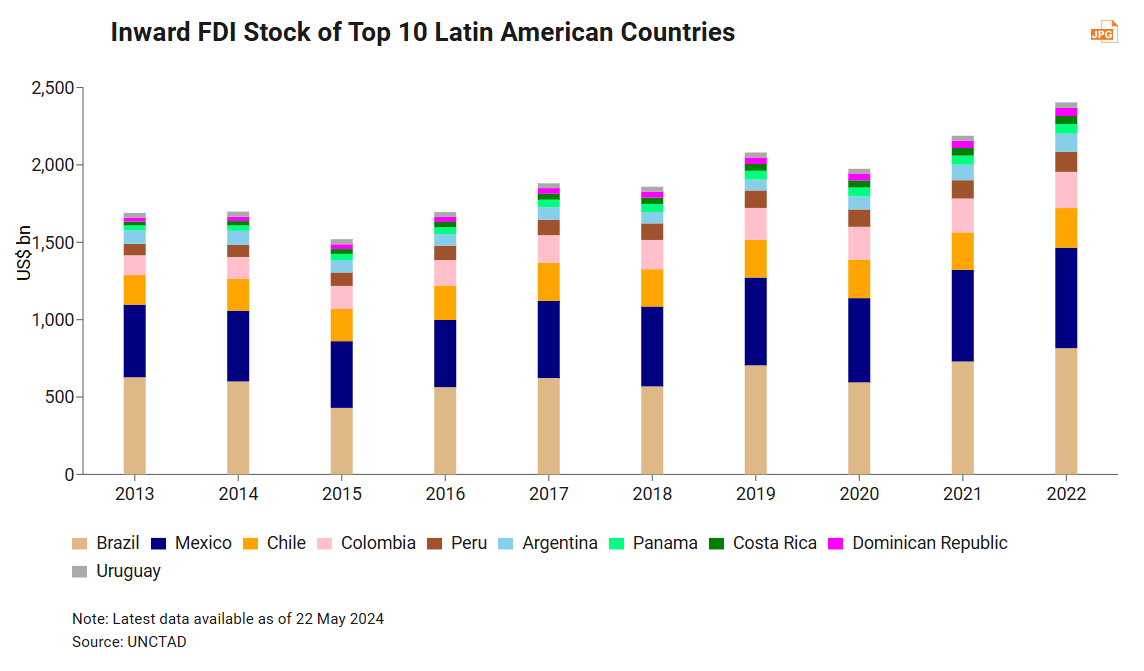

In the World Competitiveness Yearbook 2024, as issued by the International Institute for Management Development (IMD), Chile was ranked third in the Americas, behind only the US and Canada. [1] The country has consistently ranked highly for FDI in Latin America over the past decade. In 2022, it boasted a significant inward FDI stock of US$256.5 billion, accounting for approximately one‑tenth of the region’s total, as well as an inward FDI flow of US$19.8 billion.

Chile’s conducive business and investment environment has attracted investors from all over the world.

More specifically, statistics from theBanco Central de Chileshow that, in 2022, Canada was Chile’s largest investor, contributing US$35.5 billion (13.9% of the national total), followed by the US (8.9%), the Netherlands (8.3%), the UK (7.7%) and Spain (7.1%).

|

Top 8 Inward FDI (Stock) Investors in Chile in 2022 | ||

|

Total (US$ mn) |

Share (%) | |

|

World |

256,516.7 |

100 |

|

Canada |

35,537.1 |

13.9 |

|

The US |

22,758.2 |

8.9 |

|

The Netherlands |

21,220.5 |

8.3 |

|

The UK |

19,674.9 |

7.7 |

|

Spain |

18,267.5

|

7.1 |

|

Italy |

15,871.5 |

6.2 |

|

Belgium |

6,205.9 |

2.4 |

|

Japan |

4,052.5 |

1.6 |

|

Note: Latest data available as of 22 May 2024 | ||

For the same period, investments from Asia also played a notable role, cumulatively totalling some US$9.3 billion.

Japan, the country’s largest Asian investor, accounted for 44% of total Asian FDI.

Growing prominence of Chinese investment

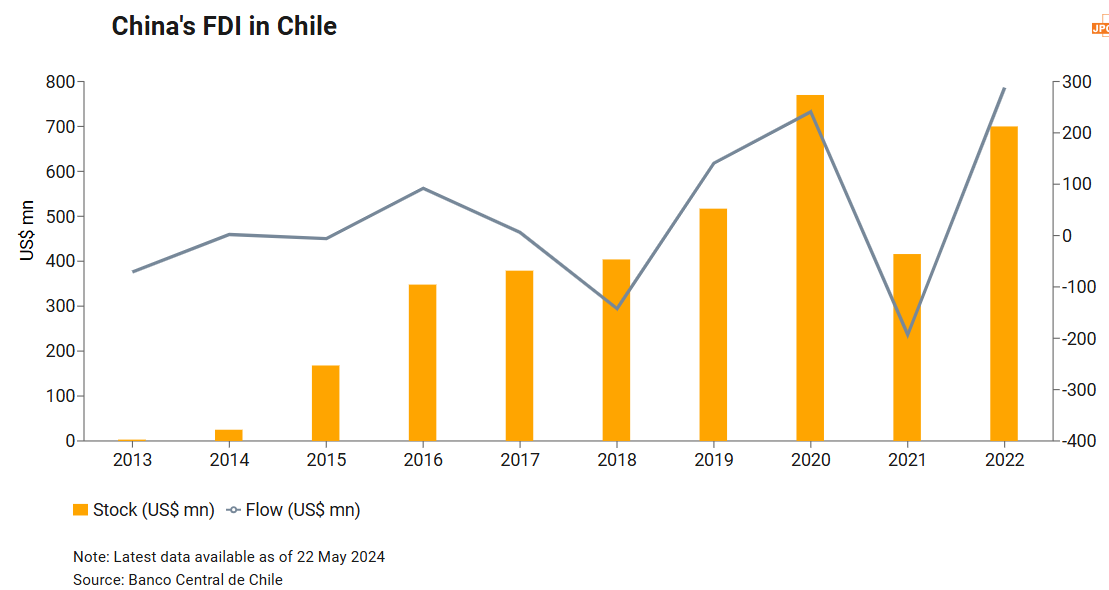

Although China has yet to become a major FDI source for Chile, the presence of mainland investment in the Andean country has

been increasing rapidly in recent years.

Chile’s foreign investment promotion agency, InvestChile, has taken proactive measures to promote investment opportunities

to prospective Chinese investors. In partnership with ProChile, Chile’s trade promotion agency, InvestChile runs an annual

promotional campaign in mainland China – Chile Week China – in order to strengthen exchanges and intera

ctions between the two nations. As an indicator of its success, mainland China’s FDI stock in Chile has grown dramatically,

rising from US$3 million in 2013 to US$700 million in 2022, representing compound annual growth of 83%.

Mainland China’s investment momentum not only marks the growing interest among the country’s investors in the Chilean market,

but also underscores the strengthening bilateral economic ties. In addition to the increasing penetration of Chinese car brands into

Chile, for example, mainland China has also made significant investments in a wide range of the Latin American nation’s mining operations.

[2]

Shaping the future

Chile has already attracted foreign capital and technology into a number of strategic sectors, including mining, energy, venture capital, food, services, tourism and infrastructure. Looking to the future, sustainability and digitalisation are seen as bright new investment prospects.

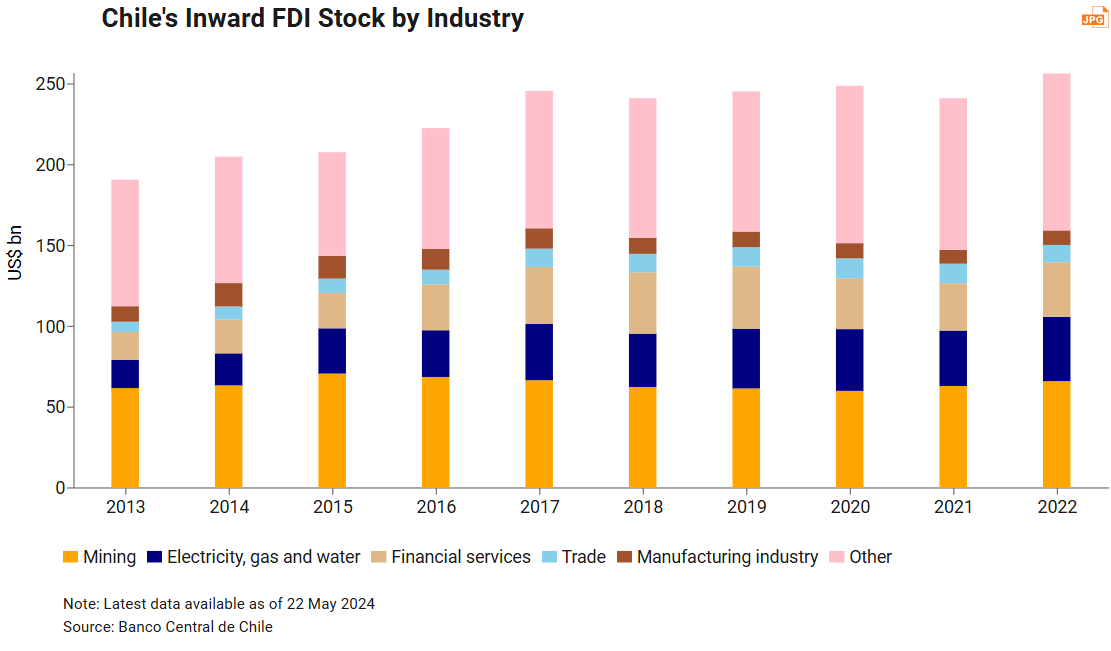

Reflecting the strength of its global mineral reserves, more than a quarter of all Chile‑bound FDI is focused on the mining sector. A major commodity exporter, Chile’s mining industry extends beyond such traditional metals as copper, silver and gold to include many important rare metals. Indeed, the Andean nation was estimated to possess 41% of the world’s lithium reserves in 2023, while also being the world’s second‑largest lithium producer, accounting for approximately one‑third of global lithium production in 2022. [3]

A French mining company has recently pledged initial investment of nearly US$100 million (in partnership with Chile’s state mining company) in a major lithium extraction project, one aimed at helping meet the rising demand for electric vehicle batteries. A further US$1 billion from the same company is said to be on the table for a variety of other lithium‑related projects. [4]

Beyond this, Chile has also set itself the ambitious goal of being carbon neutral by 2050. In order to accomplish this, the country has been accelerating its adoption of renewable energy and sustainable waste management. Looking to capitalise on its geographic and climate characteristics, Chile has already established photovoltaic solar farms in the Atacama Desert in the north of the country, as well as a wind farm in Patagonia.

Alongside these initiatives, the Chilean government has shown growing interest in utilising hydrogen as a clean fuel. To this end, in 2020, Chile unveiled a National Green Hydrogen Strategy with the goal of becoming a leading hydrogen exporter by 2030, a move seen as aligning with the nation’s sustainable, low‑carbon energy transition.

Accelerating economic development

CORFO, a Chilean economic development agency with a production promotion remit, has played a decisive role in enhancing the competitiveness and productivity of businesses operating in the country. It offers numerous supportive schemes for a range of sectors designated as priorities, including innovation, entrepreneurship, finance and sustainability.

In order to help attract national and foreign investors, the agency runs a variety of incentive schemes, including tax benefits and co‑financing options, with venture capital (via its relatively recently launched Venture Capital Chile initiative) the most popular option .

In addition to its role in attracting domestic and foreign investments for strategic projects, CORFO also aims to strengthen the development of a variety of different sectors, as well as small and medium‑sized enterprises (SMEs). Thanks to a number of its bespoke initiatives, Chilean SMEs have access to a range of free services, including training, digital transformation programmes and R&D support.

In order to help nurture the country’s SME sector, CORFO has partnered with universities and industrial players in the operation of technology centres geared to ensuring smaller businesses have access to a wide range of cutting‑edge technology. These centres offer a wealth of knowledge and experience, including customised support and technological solutions, such as protocol testing, from a number of different industry bodies and sectors, including food innovation (CeTA), the creative industries (CRT+IC), mining (CNP and CIPTEMIN), construction (CTeC), the circular economy (CircularTEC) and electromobility (CASE).

Igniting innovation

Start-Up Chile, a CORFO subsidiary organisation, meanwhile, offers comprehensive programmes designed to support start‑ups, from early‑stage, proof‑of‑concept to overseas business expansion. In addition to funding, free working spaces, discounted services and training, start‑ups are also introduced to potential investors, business partners, buyers and the appropriate global regulatory bodies.

According to the latest available figures, as of the end of 2020, there were approximately 2,283 start‑ups from 88 countries participating in various Start-Up Chile programmes. [5]. Another survey also indicated that, as well as receiving funding from official agencies, some 87% of participating start‑ups have raised capital from the private sector, including a significant proportion from overseas backers.

As of 2021, Chile was home to more than 50 start‑ups valued at US$10 million or more. Indeed, the success of such Chilean unicorns as Cornershop, NotCo and Betterfly exemplifies Chile’s suitability as a location for overseas start‑ups to thrive thanks to its vibrant innovation and start‑up ecosystem.

A prime example of this is NotCo, a foodtech firm that applies AI technology to molecular design to replicate the tastes, textures, smells and colours of animal‑based products. To date, it has successfully introduced a range of plant‑based foods, including NotMilk, NotBurger, NotChicken, and NotDulceDeLeche. In 2021, the company became the first Chilean unicorn. [6]

The Chilean start‑up ecosystem has attracted significant interest in many overseas markets. In addition to those from Spanish‑speaking countries, entrepreneurs are coming from such varied locales as the US, Brazil, India, France and Singapore. Riding on Chile’s high internet penetration and IT spending, foreign start‑ups in such fields as online messaging, online psychological consultations and online grocery, for example, have all come to view Chile as an attractive business expansion destination. [7]

[1] The World Competitiveness Yearbook measures economic competitiveness across 164 criteria grouped into four major categories – economic performance, government efficiency, business efficiency and infrastructure. Among the criteria leading to Chile being applauded for its friendly business environment are its successes on the international investment, public finance, and business legislation fronts.

[2] China’s Lithium-Triangle Inroads Show US Challenges in EV Race, Bloomberg (16 October 2023)

[3] Chilean Economy: Laying the Foundations, Quickening the Pace, Pushing the Limits (Spanish), Ministry of Finance of Chile (25 May 2024)

[4] InvestChile (25 April 2024)

[5] Annual Alumni Passport, Start-Up Chile (27 March 2023)

[6] How One CEO Is Using AI to Develop New Plant-Based Foods, Time (16 May 2024)

[7] International start-ups explain why they chose Chile, InvestChile (29 October 2021)

First, please LoginComment After ~