Surge in China's Yuan Loans Sparks Economic Momentum, Reflecting Bold Growth Policies

Data from PBOC

China's financial landscape is seeing a significant uptick in yuan-denominated loans, with the first ten months of 2024 witnessing an increase of ¥16.52 trillion (about $2.3 trillion USD). This rapid expansion highlights the country's strategic focus on bolstering liquidity to support real economic activity.

Loan and Money Supply: Driving Economic Activity

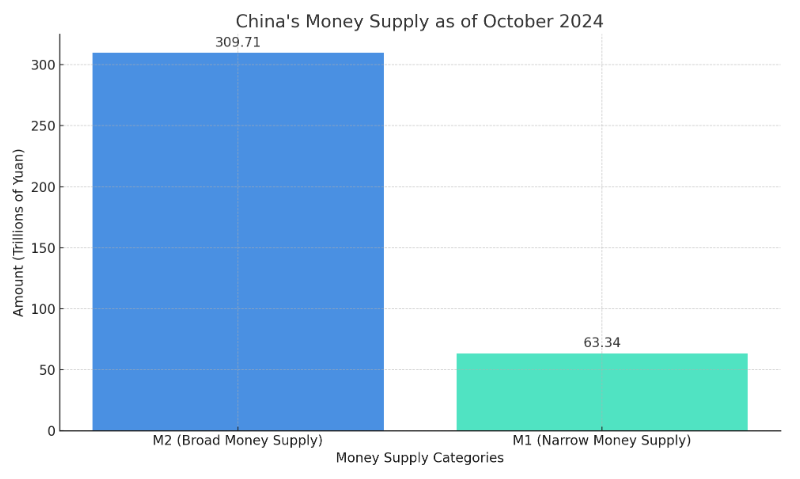

China's M2 money supply—a broad measure encompassing cash and deposits—grew by 7.5% year-on-year to an impressive ¥309.71 trillion by the end of October. Experts note that this substantial rise in M2 indicates a deliberate approach to stimulating economic activity and market confidence amid global uncertainties.

In contrast, M1 (cash and demand deposits) declined by 6.1% from the previous year, totaling ¥63.34 trillion. This decrease in M1 suggests a reallocation of funds by households and businesses, reflecting shifts in financial strategies and spending behaviors. On the other hand, M0, representing cash in circulation, rose by 12.8% to ¥12.24 trillion, showcasing a resurgence in consumer spending power backed by supportive policies.

Sector-Focused Lending: Supporting Key Economic Drivers

The breakdown of lending reveals targeted capital flows into critical economic areas. Household loans increased by ¥2.1 trillion, with long-term loans, including mortgages, comprising ¥1.65 trillion, underscoring strong demand in the housing sector. Corporate loans also surged, with businesses securing an additional ¥13.59 trillion in funding, driven by a need for medium- to long-term financing to sustain growth. Additionally, non-bank financial institutions saw loan growth of ¥2.987 trillion, indicating a diversified approach to financial sector support.

Deposits also saw robust growth, with yuan deposits rising by ¥17.22 trillion through October. Household deposits led this increase, adding ¥11.28 trillion, reflecting solid trust in the financial system. By contrast, corporate deposits decreased by ¥2.84 trillion, suggesting a possible shift in capital allocation toward business operations or investments.

Active Financial Markets: Reinforcing Confidence

October saw active engagement in the interbank market, with total RMB transactions reaching ¥172.48 trillion, highlighting high market liquidity. Average daily transactions rose by 17.1% year-on-year, while borrowing costs remained low, with interbank rates averaging 1.59% and bond repo rates at 1.65%. These favorable borrowing conditions are seen as catalysts for investment and reflect a well-coordinated effort to maintain capital flow and financial stability.

A Path Forward for Sustained Economic Growth

The financial data paints a comprehensive picture of China's commitment to economic growth, from robust lending and liquidity measures to active financial markets. This balanced, data-driven approach signals confidence in China's economic trajectory, positioning the financial sector as a vital engine of support for sustained growth amid global challenges.

First, please LoginComment After ~