PBOC:Financial Statistics Report (Q1-Q3 2024)

1. Broad money rose by 6.8 percent

At end-September, broad money supply (M2) stood at RMB309.48 trillion, increasing by 6.8 percent year on year. Narrow money supply (M1), at RMB62.82 trillion, decreased by 7.4 percent year on year. The amount of currency in circulation (M0) was RMB12.18 trillion, an increase of 11.5 percent year on year. The first three quarters of the year saw a net money injection of RMB838.6 billion.

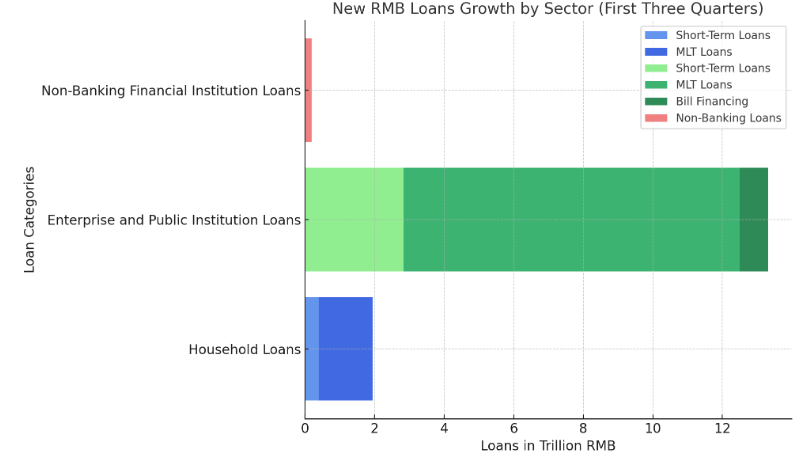

2. RMB loans grew by RMB16.02 trillion in the first three quarters

At end-September, outstanding RMB and foreign currency loans totaled RMB257.71 trillion, up 7.6 percent year on year. Outstanding RMB loans stood at RMB253.61 trillion, registering a year-on-year growth of 8.1 percent.

In the first three quarters, new RMB loans amounted to RMB16.02 trillion. By sector, household loans increased by RMB1.94 trillion, with short-term loans and medium and long-term (MLT) loans rising by RMB402.4 billion and RMB1.54 trillion, respectively; loans to enterprises and public institutions grew by RMB13.46 trillion, with short-term loans, MLT loans and bill financing rising by RMB2.83 trillion, RMB9.66 trillion and RMB828.3 billion, respectively; and loans to non-banking financial institutions grew by RMB188.7 billion.

At end-September, outstanding foreign currency loans stood at USD585.5 billion, down 14.6 percent year on year. In the first three quarters, foreign currency loans dropped by USD70.9 billion.

3. RMB deposits increased by RMB16.62 trillion in the first three quarters

At end-September, the outstanding amount of RMB and foreign currency deposits was RMB306.83 trillion, up 7.1 percent year on year. RMB deposits recorded an outstanding amount of RMB300.88 trillion, rising by 7.1 percent year on year.

In the first three quarters, RMB deposits increased by RMB16.62 trillion. Specifically, household deposits, fiscal deposits and deposits of non-banking financial institutions rose by RMB11.85 trillion, RMB724.8 billion and RMB4.5 trillion, respectively, while deposits of non-financial enterprises fell by RMB2.11 trillion.

At end-September, the outstanding amount of foreign currency deposits was USD849.1 billion, up 9 percent year on year. In the first three quarters, foreign currency deposits rose by USD51.2 billion.

4. The monthly weighted average interest rates for interbank RMB lending and bond pledged repos in September stood at 1.78 percent and 1.83 percent respectively

Lending, cash bond and repo transactions in the interbank RMB market totaled RMB1583.16 trillion for the first three quarters, with the daily average declining by 2.8 percent year on year to RMB8.38 trillion. Specifically, the average daily turnovers of interbank lending and pledged repo trading fell by 31.4 percent and 5.6 percent year on year, respectively, while that of cash bond trading increased by 25.7 percent year on year.

The monthly weighted average interest rate for interbank lending in September stood at 1.78 percent, up 0.01 percentage points month on month but down 0.09 percentage points year on year. The monthly weighted average interest rate for pledged repos was 1.83 percent, up 0.04 percentage points month on month but down 0.13 percentage points year on year.

5. Official foreign exchange reserves stood at USD3.32 trillion

At end-September, China’s foreign exchange reserves stood at USD3.32 trillion, and the USD/CNY exchange rate was 7.0074.

6. RMB cross-border settlement under the current account reached RMB11.76 trillion and RMB cross-border settlement of direct investment posted RMB6.04 trillion for the first three quarters

RMB cross-border settlement under the current account reached RMB11.76 trillion for the first three quarters, including RMB8.88 trillion in settlement of trade in goods and RMB2.88 trillion in settlement of trade in services and other current account items. RMB cross-border settlement of direct investment amounted to RMB6.04 trillion, of which ODI and FDI posted RMB2.11 trillion and RMB3.93 trillion, respectively.

Notes:

1. Data for the current period are preliminary.

2. Starting from 2015, deposits of non-banking financial institutions have been included in RMB deposits, foreign currency deposits and deposits in RMB and foreign currencies, while lending to non-banking financial institutions has been included in RMB loans, foreign currency loans and loans in RMB and foreign currencies.

3. “Loans to enterprises and public institutions” in this report refers to loans to non-financial enterprises, government agencies and organizations.

4. Starting from December 2022, e-CNY in circulation has been included in the amount of currency in circulation (M0). At end-December, e-CNY in circulation stood at RMB13.61 billion. The revision has not caused notable changes to month-end M1 or M2 growth rates of 2022. Shown below are the revised M0 growth rates.

Jan. 2022 | Feb. 2022 | Mar. 2022 | Apr. 2022 | May 2022 | Jun. 2022 | |

Currency in circulation (M0) | 18.5% | 5.8% | 10.0% | 11.5% | 13.5% | 13.9% |

Jul. 2022 | Aug. 2022 | Sept. 2022 | Oct. 2022 | Nov. 2022 | Dec. 2022 | |

Currency in circulation (M0) | 13.9% | 14.3% | 13.6% | 14.4% | 14.1% | 15.3% |

5. Starting from January 2023, the People’s Bank of China has incorporated into the coverage of financial statistics three types of non-depository banking financial institutions, i.e., consumer finance companies, wealth management companies and financial asset investment companies. At end-January 2023, loans issued by the three types of institutions recorded an outstanding balance of RMB841 billion, posting an increase of RMB5.7 billion for the month, while their deposits registered an outstanding amount of RMB22.2 billion, rising by RMB2.7 billion over the month. All the statistics in this report are provided on a comparable basis.

First, please LoginComment After ~