MAS Monetary Policy Statement - October 2024

INTRODUCTION

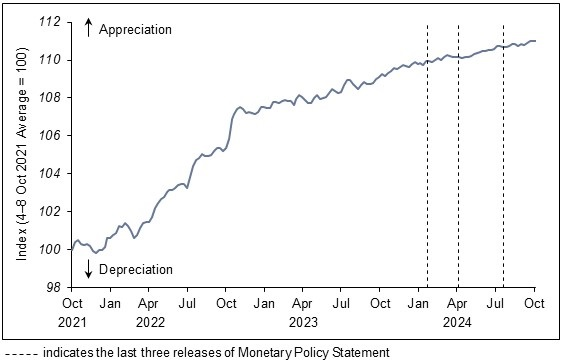

1. In the July 2024 Monetary Policy Statement, MAS maintained the rate of appreciation of the Singapore dollar nominal effective exchange rate (S$NEER) policy band, with no change to the width of the band or the level at which it was centred. Since then, the S$NEER has been appreciating gradually in line with the policy band.

Chart 1

S$ Nominal Effective Exchange Rate (S$NEER)

GROWTH BACKDROP

2. The global economy has remained broadly resilient. Growth has been steady in the US, sustained by domestic demand, but has been weaker in the Euro area. In China, exports were buoyant in the first half of 2024, but domestic spending continued to be subdued amid the housing market downturn. Regional economies meanwhile have benefitted from the sustained upturn in the global electronics cycle, with investments supported by tech-related activities.

3. Singapore's major trading partners are expected to stay on a steady expansion path in the quarters ahead. Final demand will be underpinned by further declines in interest rates as inflation moderates worldwide. Recent policy interventions should also help stabilise near-term growth in China.

4. According to MTI's Advance Estimates, the Singapore economy expanded by 2.1% on a quarter-on-quarter seasonally-adjusted basis in Q3, accelerating from the average of 0.4% in the first half of the year. Growth momentum was stronger than expected, and was largely underpinned by a step-up in manufacturing output, particularly in the electronics industry. Activity also picked up in the modern services cluster.

5. For the rest of 2024, Singapore's growth should be sustained by the ongoing upswing in the electronics and trade cycles as well as the easing in global financial conditions. For the year as a whole, MAS expects GDP growth to come in around the upper end of the 2–3% forecast range. The negative output gap is projected to close in H2 2024.

6. Next year, the Singapore economy is currently forecast to expand at close to its potential rate. However, there is significant uncertainty around the economic outlook, reflecting continuing risks in the external environment. A sharp escalation in geopolitical and trade conflicts could exert sizeable drags on global and domestic investment and trade. There is also uncertainty around the pace and impact of global macroeconomic policy easing, and with it, the durability of the electronics upturn.

INFLATION OUTLOOK

7. MAS Core Inflation[1] stepped down to 2.6% y-o-y in Jul–Aug, from 3.0% in Q2, as consumer price increases fell across a broad range of goods and services. Excluding the impact of the GST hikes, core inflation is estimated to have edged below 2.0% in Jul–Aug. The seasonally adjusted three-month/three-month rate[2] of core inflation also declined to an annualised rate of 0.9% in August, reflecting a slower pace of price increases in food services, including hawker food, as well as a range of retail and household durable goods.

8. Core inflation momentum is expected to remain contained in Q4, which would imply a further slowing in its y-o-y rate over the next few months. Core inflation should end the year around 2%, and average between 2.5%–3.0% for 2024 as a whole, down from 4.2% in 2023. CPI-All Items inflation fell to 2.3% y-o-y in Jul–Aug and should come in around 2.5% this year, compared to 4.8% in 2023.

9. Amid moderate underlying cost pressures, MAS Core Inflation is expected to average around the mid-point of the forecast range of 1.5–2.5% in 2025. Imported costs are forecast to be broadly stable next year, reflecting an anticipated unwinding of oil production cuts and favourable weather conditions for food supply. CPI inflation in Singapore’s major trading partners should also largely be in line with pre-pandemic norms. On the domestic front, unit labour costs are projected to rise more gradually, alongside moderating nominal wage growth as well as a recovery in productivity.

10. CPI-All Items inflation is forecast to average 1.5–2.5% as well in 2025. Accommodation inflation should slow as leasing demand falls, partly offsetting an anticipated pickup in private transport inflation amid still-firm car purchases.

11. The risks to Singapore's inflation outlook are more balanced compared to three months ago. If there is stronger-than-anticipated demand for labour due to upsides in GDP growth, it may take longer for unit labour cost growth to moderate and consequently for services price inflation to normalise. An intensification of geopolitical tensions and commodity price shocks could add to imported costs. However, a significant downturn in the global economy would induce an abrupt easing in cost and price pressures, causing domestic inflation to come in materially lower than expected.

MONETARY POLICY

12. Singapore's growth momentum has picked up and the negative output gap is projected to close in H2 2024. Barring a weakening in global final demand, the economy should continue to expand at a steady pace and keep close to its potential path in 2025. MAS Core Inflation has stepped down but is anticipated to decline further to around 2% by the end of 2024.

13. Based on this outlook, MAS assesses that the monetary policy settings are for now still consistent with medium-term price stability.

14. MAS will therefore maintain the prevailing rate of appreciation of the S$NEER policy band. There will be no change to its width and the level at which it is centred.

***

[1] MAS Core Inflation excludes the costs of accommodation and private transport from CPI-All Items inflation.

[2] The seasonally adjusted three-month/three-month rate as at August 2024 compares price levels in Jun–Aug 2024 against price levels in Mar–May 2024. This sequential measurement better captures the most recent pace of inflation in the economy.

First, please LoginComment After ~