Net interest margin of EU/EEA banks slightly decreased on a quarterly basis

The European Banking Authority (EBA) today published its Q2 2024 quarterly Risk Dashboard (RDB), which discloses aggregated statistical information for the largest EU/EEA institutions.

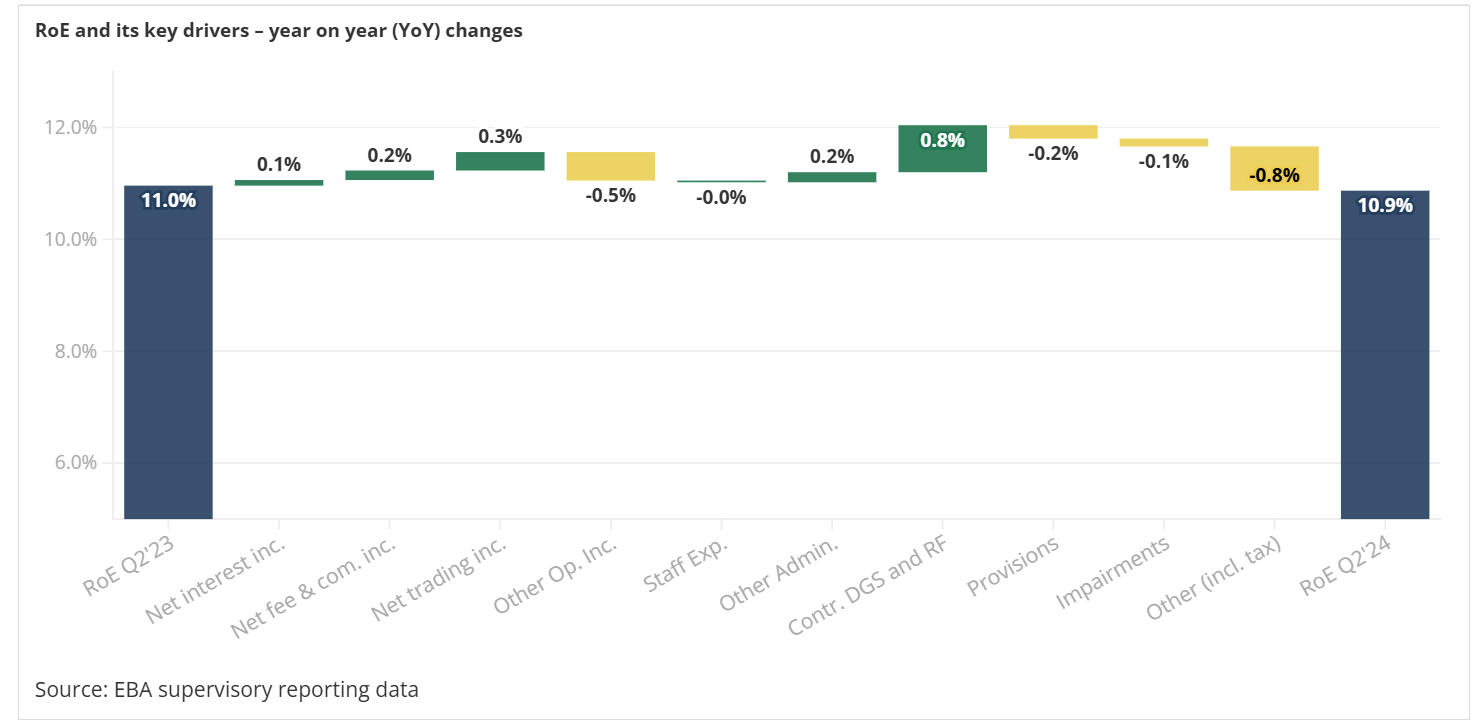

·EU/EEA banks' return on equity (RoE) remained nearly unchanged on a yearly basis, reaching 10.9%, 10bps lower than one year ago. On a quarterly basis the RoE increased by 30bps, mainly driven by a rise in other operating income.

·The net interest margin (NIM) declined slightly (1.68% in Q2 vs. 1.69% in Q1, 1.60% one year ago), indicating that it might have reached its peak in Q1 2024. As volume growth could not compensate for the negative impact from the NIM, net interest income declined slightly on a quarterly basis.

·EU/EEA banks' common equity tier 1 (CET1) ratio rose on a fully loaded basis by 10bps to 16.1% in Q2 2024. The liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) similarly rose in the second quarter (from 161.7% to 163.2% and from 127.3% to 127.8%, respectively). In the LCR's numerator, the share of cash and reserves held by EU/EEA banks further decreased, while the share of central government assets increased.

·Loans to households and non-financial corporates slightly increased over the quarter. Sovereign exposures increased since the end of last year by around EUR 200bn (+5.5%), accompanied by a rise of the share of exposures recognised at fair value, and a rise of the share of shorter-term maturities. The non-performing loan (NPL) ratio remained stable at 1.9%, with material divergences across segments.

RoE remained nearly stable on a yearly basis as the rise in net interest (NII), fee (NFCI) and trading (NTI) income compensated for a decline in other operating income. On the cost side, the contribution to deposit guarantee schemes (DGS) and resolution funds declined, which compensated for a rise in other expenses, including taxes.

Documents

Risk Dashboard - Q2 2024

(3.71 MB - PDF)

DownloadRisk Dashboard statistical annex Q2 2024 [xls]

(4.73 MB - Excel Spreadsheet)

DownloadCredit Risk parameters annex - Q2 2024 [pdf]

(871.82 KB - PDF)

DownloadCredit Risk parameters annex - Q2 2024 [xlsx ]

(127.14 KB - Excel Spreadsheet)

Download

First, please LoginComment After ~