Zambia Monetary Policy Report(May 2024)

May 2024 Monetary Policy Report

This Monetary Policy Report (MPR) is made pursuant to Section 29(2) of the Bank of Zambia Act, 2022.

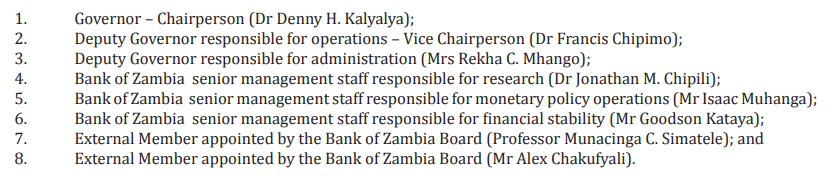

This MPR was approved by the Monetary Policy Committee on May 13, 2024 and contains the information available as of May 7, 2024. Composition of the Monetary Policy Committee constituted pursuant to Section 28(1) of the Bank of Zambia Act, 2022:

Preface

In line with Article 213(2) (b) of the Constitution of Zambia (Amendment) Act, 2016, the Bank of Zambia determines monetary policy. The nine-member Monetary Policy Committee (MPC) formulates monetary policy to achieve and maintain price stability in line with section 27(2) of the Bank of Zambia Act, 2022. The Committee meets every second month of the quarter in February, May, August and November to decide on the monetary policy stance. In doing so, the Committee reviews macroeconomic developments in the previous quarter and prospects for inflation over the forecast horizon currently eight quarters ahead. This information is published in the Monetary Policy Report (MPR) to strengthen transparency and accountability of the MPC.

The stance of monetary policy is reflected in changes to the Policy Rate introduced in April 2012. This is guided by inflation outcomes, forecasts from inflation models and identified risks, including those associated with growth and financial stability. The MPC relies on a forward-looking monetary policy framework anchored on the Policy Rate as a key signal for the policy stance. The Policy Rate also provides a credible and stable anchor to financial market participants in setting their own interest rates as well as guides the Bank in its implementation of monetary policy. The Bank may use non-price (quantitative) monetary policy instruments, such as, the statutory reserve ratio in its conduct of monetary policy.

The Bank influences the overnight interbank rate (operating target) which in turn impacts on inflation through changes in market interest rates transmitted via the expectations, exchange rate and/or credit channels. To effectively manage the overnight interbank rate, the Bank conducts open market operations to either supply or withdraw liquidity from the banking system to keep the overnight interbank rate within the corridor of +/- 1 percentage points around the Policy Rate. There are, however, exceptional circumstances where the interbank rate may be allowed to drift outside the Policy Rate Corridor.

The monetary policy decision is publicly announced in the Monetary Policy Committee Statement issued via a press release a day after each quarterly MPC meeting. The MPR is published soon after the MPC Meeting. This is intended to provide detailed information used by the MPC in arriving at a Policy Rate decision.

Executive Summary

The Monetary Policy Committee, at its May 13-14 2024 Meeting, decided to raise the Monetary Policy Rate by 100 basis points to 13.5 percent. The decision was guided by the need to contain inflationary pressures and anchor inflation expectations as inflation continues to move further away from the target band of 6-8 percent. If left unchecked, macroeconomic stability and efforts towards robust and sustained growth could be undermined. The decision augmented earlier actions taken to contain persistent inflationary pressures, acting mostly through the exchange rate channel, and addressing rising inflation expectations.

In making this decision, the Committee considered external and domestic economic developments during the first quarter of 2024. It was noted that the global economy remained resilient although challenges related to the restrictive monetary policy stance, tight global financial conditions and geopolitical tensions continued to weigh on domestic inflation and growth.

Inflation rose to 13.5 percent in the first quarter of 2024 from 12.9 percent in the last quarter of 2023 mainly due to rising food and energy prices as well as sustained depreciation of the exchange rate. While the depreciation of the Kwacha against the US dollar continued to contribute to inflationary pressures, the pace of depreciation moderated owing to tight monetary policy and positive market sentiments as significant progress was made on external debt restructuring. Inflation is expected to remain above the target band of 6-8 percent in 2024 and 2025, but return to the target band in the first quarter of 2026 as global food prices decline further and the external sector environment improves. The recent trend in exchange rate depreciation as well as the adverse impact of the drought on food and energy prices will keep inflation elevated in 2024.

Interest rates have broadly increased following the tightening of monetary policy in February. Consequently, lending to both Government and the private sector reduced in the first quarter resulting in a slowdown in credit and money supply growth.

During the first quarter of 2024, preliminary estimates indicate that revenue was broadly in line with the target despite lower tax collections from the mining sector. However, Government spending was lower than planned largely due to constrained domestic financing.

Real GDP is estimated to have slowed down in the first quarter of 2024 to 3.5 percent from 8.0 percent in the last

quarter of 2023 mainly on account of slower growth in construction and tourism sectors. For 2024 as a whole,

domestic growth has been significantly downgraded to 2.3 percent from the earlier 4.4 percent projection mostly

due to the adverse impact of the drought. The most affected sectors are agriculture and energy. The current account

is also projected to deteriorate in 2024 as the drought has necessitated the importation of significant amounts of

the staple food (maize grain) and electricity. However growth is expected to rebound over the medium-term as

mining and agriculture sectors recover.

First, please LoginComment After ~