Private Debt Funds: What They Are and Trends under Interest Rate Hikes

Abstract

Private Debt (PD) funds are those that specialize in providing loans mainly to middle-market firms with low creditworthiness. Their assets under management (AUM) have expanded mainly in the U.S., as their borrower-investor bases have broadened, against the background of growing investment needs in the low interest rate environment and the strengthening of financial regulations after the global financial crisis. However, with the recent interest rate hikes in the U.S. and Europe, both the average time required to raise new funds and concentration in major PD funds have increased, and the amount of fundraising for new funds has declined. In Japan the market size of PD funds is extremely limited relative to the U.S. and Europe. Potential risks of PD funds include opacity due to lack of disclosed information, the interconnectedness within the financial system, the accumulation of vulnerabilities associated with rapid credit growth, and the liquidity risk of open-end funds. It is necessary to pay close attention to these developments, including their impact on the efficient allocation of resources for sustainable economic growth in the longer run.

Introduction

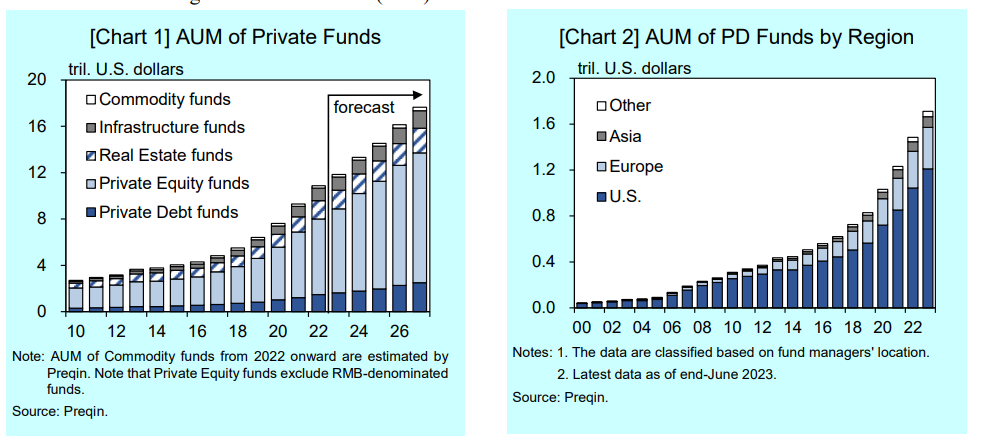

Private funds are those that raise capital from limited investors. Among private funds, those that invest in firms are known as Private Equity (PE) funds and those that provide loans to firms are known as Private Debt (PD) funds. 1,2 The AUM of private funds has expanded, reflecting the growing investment needs of investors seeking high yields and risk diversification in alternative assets under the prolonged low interest rate environment after the global financial crisis (GFC).

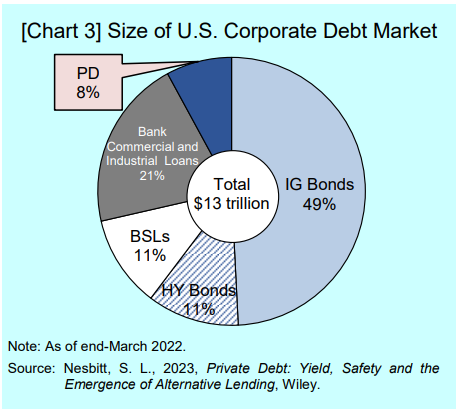

This expansion is forecast to continue (Chart 1). The expansion of the private fund market has been driven by PE funds so far, but in recent years, the contribution of PD funds, which provide loans mainly to middle-market firms with low creditworthiness, has increased. Although the AUM of PD funds is only about one-fifth the size of PE funds at about $1.7 trillion as of end-June 2023, their AUM has nearly quadrupled over the past decade, and their presence has grown, especially in the U.S. (Chart 2).

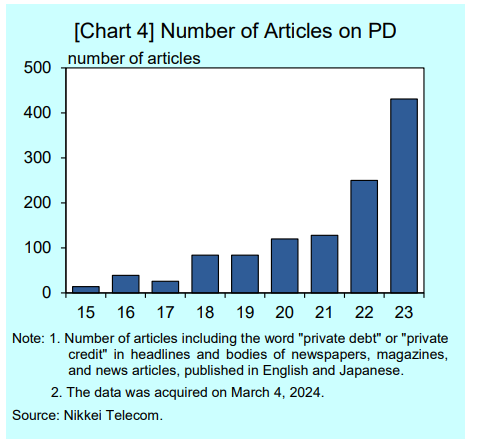

Reflecting this expansion, PD now accounts for a little less than 10% of the U.S. corporate debt market, compared with about 60% for corporate bonds (sum of Investment Grade (IG) and High Yield (HY) bonds) and 30% for bank loans (sum of bilateral loans and syndicated loans) (Chart 3).

PD funds have expanded against the background of growing investment needs under the prolonged low interest rate environment. In addition, the reasons behind the expansion include (i) PD funds' role as supplementing financial intermediation to firms, especially in the U.S., amid the strengthening of financial regulations on banks after the GFC, (ii) a recent broadening in borrower-investor bases, and (iii) a tightening in banks' lending standards in response to the recent rise in interest rates and the bankruptcy of U.S. regional banks.

In this connection, the market size of PD funds in Japan is extremely limited relative to the U.S. and Europe. This is because the Japanese debt market is dominated by domestic banks, and the loan interest rates are not commensurate with the PD funds' expected risk and return as they are lower than those in the U.S. and Europe.

Under these circumstances, there has recently been an increasing interest in PD funds as they have been mentioned many times by the media and featured in numerous reports by major central banks and international organizations (Chart 4). In February 2022, this BOJ Review Series also covered PD funds by focusing on the characteristics of their lending methods and performance. 3 In light of changes in the environment since then, this report focuses on recent characteristics of entities that are involved in PD funds, trends during the recent interest rate hikes, and potential risks of PD funds.

First, please LoginComment After ~