2023年10月银行间债券市场境外业务运行情况

截至2023年10月底,以法人为统计口径,541境外机构投资者通过结算代理模式入市,本月新增2家;814家境外机构投资者通过债券通模式入市,本月新增2家。

By the end of October 2023, in terms of incorporated entities, 541 overseas investors have registered through CIBM Direct scheme, adding 2 new entities over last month. 814 overseas investors through Bond Connect scheme, adding 2 new entities over last month.

截至10月底境外机构入市情况

(Registered number of overseas investors by the end of October)

10月,境外机构投资者共达成现券交易11705亿元1,同比增加29%、环比减少7%,交易量占同期现券市场总成交量的约5%。10月,境外机构投资者买入债券6882亿元,卖出债券4823亿元,净买入2058亿元。其中,通过结算代理模式达成4274亿元(代理交易4102亿元、直接交易172亿元),净买入1594亿元;通过债券通模式达成7431亿元,净买入464亿元。

In October, the cash bond trading turnover of overseas investors amounted to 1170.5 billion yuan1, with increase of 29% YoY and decrease 7% MoM. This amount represented about 5% of the total turnover for interbank cash bond market of the same month. The total monthly figure comprised 688.2 billion yuan of bond purchase and 482.3 billion yuan of bond sell, giving a net purchase of 205.8 billion yuan. The turnover reached 427.4 billion yuan for CIBM Direct (410.2 billion yuan through agent trade and 17.2 billion yuan through Direct-RFQ service) with net purchase of 159.4 billion yuan, and 743.1 billion yuan for Bond Connect with net purchase of 46.4 billion yuan.

10月,境外机构投资者在延长时段共成交1260亿元,占同期境外机构交易量的约11%。

In October, overseas investors traded 126.0 billion yuan during extended trading hours, which accounted for 11% of the total turnover of overseas investors.

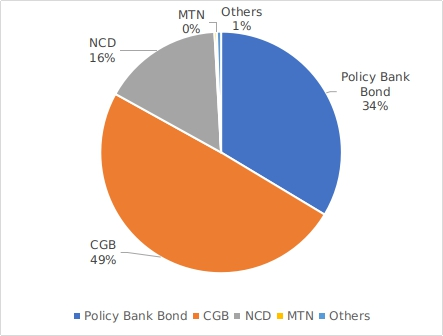

10月境外机构投资债券类型分布

(Bond Type)

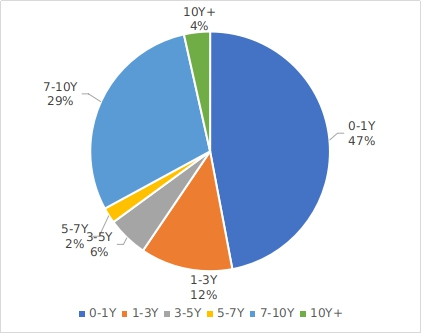

10月境外机构投资债券待偿期分布

(Bond Tenor)

10月境外机构现券交易结算周期分布

(Settlement Cycle)

由于进位原因,各项数字加总或与总计数字略有出入。

Due to rounding, some totals may not correspond with the sum of the separate figures.

南向通方面,10月境内机构持续投资交易境外债券,主要为离岸人民币债、美元债等。

In October, onshore investors mainly traded CNH bonds, USD bonds and others through Southbound Bond Connect.

请先 登录后发表评论 ~