Monetary and fiscal policy: safeguarding stability and trust

Download full text → PDF full text

Some things never change. One of them is monetary and fiscal policy’s perennial search for coherence and stability. The two policies are simply too closely intertwined. And their influence on the economy too powerful.

Over the past year, we have seen the latest example of tensions. Monetary policy has been restraining aggregate demand to quench inflation; fiscal policy has been boosting it to shield activity from higher commodity prices. And higher interest rates have widened fiscal deficits.

But the challenges go way beyond the short-term policy mix. They have to do with long-term trajectories and their cumulative impact. This is the focus of this year’s Annual Economic Report.

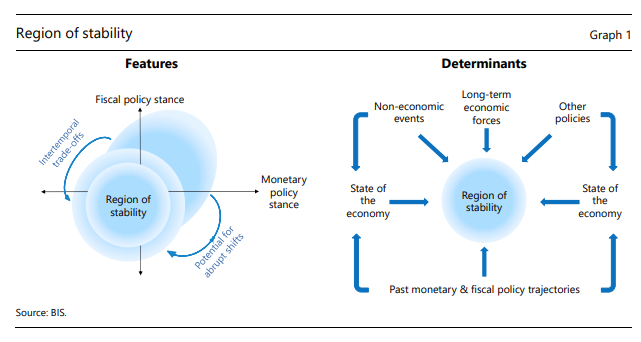

To shed light on those challenges, we put forward the notion of the region of stability. The region maps constellations of the two policies that foster sustainable macroeconomic and financial stability, and that keep tensions between the policies manageable.

We reach three conclusions.

First, even before the Covid crisis struck, the two policies had been approaching the boundaries of the region. Hence the recent unique combination of high inflation and widespread financial vulnerabilities.

Second, looking ahead, longer-term government debt trajectories pose the biggest threat. They have been relentlessly narrowing the region of stability and will continue to do so.

Finally, operating firmly within the region calls for adjustments to strategies, institutions and, above all, mindsets. The objective is to dispel a kind of “growth illusion” – a de facto excessive reliance on monetary and fiscal policy to drive growth.

Let me say a few words about the nexus between monetary and fiscal policy as well as the region of stability, the journey to the boundaries, the risks ahead and the policy implications.

First, please LoginComment After ~