The Road to Net Zero: Delivering a Sustainable Data Centre Future

Data centres have therefore become an increasingly essential piece of infrastructure, supporting data‑dependent sectors like financial services, trading and logistics. They also provide the catalyst for the development of new content and applications under the Web3 development, and the application of technologies such as blockchains and metaverse, and cloud computing services.

Secure, high‑performance data centre services are crucial for their operation and continuous growth. With an exponential increase in online data and the advent of cloud computing and the metaverse, the demand for data centre facilities and services is surging, creating tremendous opportunities for the data centre sector.

There is the potential for strong growth in the demand for data centres in Hong Kong. This is thanks to its robust telecommunications infrastructure, its reliable power supply with comparatively low tariffs, its pro‑business environment, its proximity to the mainland China market, its effective protection of data privacy and information security, its supply of knowledgeable professionals and, in addition to all this, government support.

To discover more about how the data centre industry has been mushrooming in Hong Kong, Louis Chan, Principal Economist (Global Research) at HKTDC, interviewed Charles Lee, Chairman of the Hong Kong Data Centre Association and founder and CEO of OneAsia Network Limited.

Chan: How has Hong Kong been doing in terms of data centre development in recent years, especially given the moves the Hong Kong government has made to accommodate data centres? How has this development been affected by the Covid-19 pandemic?

Lee: The robust development of technology and telecommunications has caused an unprecedented rise in demand for data centres. The volume of data flow across the world increased exponentially by 29.5 times in the 2010‑2020 decade, and will more than double between 2020 and 2024.

As a major financial and international trading and logistics hub and home to the regional offices and headquarters of many global corporations, Hong Kong is the second biggest data centre market in the Asia Pacific region [1] and the sixth biggest in the world. The number of operators in Hong Kong has grown from 17 in 2012 to 37 in 2020. This is also due to the substantial investment made in both infrastructure (hardware and capacity building) and software (new technologies).

Business tends to locate where the market is and so do data centres. The unrivalled connection Hong Kong has with mainland GBA cities creates substantial demand for data centre services of high security and serviceability. This provides Hong Kong data centre operators with unparalleled opportunities to grow – in particular in the areas of cloud computing, e‑business, Internet of Things (IoT) and logistics – alongside the internationalisation of mainland China’s service industries, including the information industry.

The gross floor area used for data centres doubled between 2015 and 2022 to reach 11m sq. feet. The Hong Kong data centre market continues to see enormous investment growth, reaching US$30.7bn in 2022, a figure nearly six times higher than five years before. Further growth of 14% is expected between now and 2027.

Up‑and‑coming: Hong Kong adds new data centre locations in Tuen Mun, Tsing Yi

Lantau Island and Lok Ma Chau. Source: OneAsia Network Limited

There are many drivers behind the growth in Hong Kong’s data centre sector – such as its robust telecommunications infrastructure (with nine satellites, 12 submarine fibre cable systems providing about 90 terabits per second in capacity and 20 overland optical fibre cable systems, supporting 5G coverage for more than 90% of the population). Then there is the excellent water and power supplies (with a reliability level exceeding 99.999%) which reduce the risks of data loss and infrastructure damage, the city’s favourable micro‑climate and geographical location immune from natural disasters, its free flow of information with no censorship of content and adequate protection of data privacy, and its strong R&D capability linked to its famous universities. Furthermore, it has a pro‑business environment with strong government policies, supporting data centre investors and operators by converting existing industrial buildings, sourcing land from greenfield sites, drawing up territory‑wide cavern development plans, and purchasing or renting commercial sites in the open market.

All of this has been a shot in the arm for the city’s data centre market. For instance, the reactivation of the Revitalisation of Industrial Buildings Scheme announced in the 2018 Policy Address has released plenty of spaces for industries such as data centres. And the synergy between the upcoming San Tin/Lok Ma Chau Development Node, in which 57 of its 320 hectares will be allocated to Enterprise and Technology Park, and the proposed Hong Kong-Shenzhen Innovation and Technology Park (HSITP), which boasts a gross floor area of 1.2m sq. metres, will quicken the pace of the city’s I&T development.

In addition to helping increase the supply of land available, the HKSAR Government is also committed to making Hong Kong a prime location for data centres in the Asia Pacific by introducing and implementing a number of measures to facilitate this. These include the establishment of the Data Centre Facilitation Unit under the Office of the Government Chief Information Officer (OGCIO) in July 2011, which will provide one‑stop support to overseas and local enterprises interested in setting up data centres in Hong Kong. It liaises with government departments on matters such as statutory processes and compliance requirements.

Covid-19 has triggered an acceleration in digitalisation at individual, corporate and national levels, which has put network and telecommunications reliability into the spotlight. Social distancing and nationwide lockdowns have driven the increased use of digital technologies. As a result, data centres have become the backbone of the 85% of Hong Kong enterprises using cloud computing to thrive during the pandemic.

From a city’s perspective, any smart initiative that depends on open, scalable, and cross‑sectional systems to promote the application of artificial intelligence (AI), big data analysis and real‑time, cloud‑ready services, needs its data storage capacity to be resilient. This gives the network and telecommunications infrastructure a great incentive to scale up with better disaster recovery and backup solutions to strengthen its availability and integrity.

Chan: Data centre use has shifted at a dramatic pace from simple servers to enabling hybrid digital infrastructures. It’s estimated that 85% of infrastructure strategies will integrate on-premises, co-location, cloud and edge delivery options by 2025, compared with 20% in 2020. How is this global trend going to affect Hong Kong’s data centre industry?

Lee: The pandemic has created a paradigm shift in the way people live. Education has changed from face‑to‑face classes to face‑to‑screen online courses. Jobs have been transformed from commuting to the office to working from home. This has resulted in a higher demand for supporting technologies, such as data centres.

On the business front, there are growing calls for big data analysis, and real‑time decision‑making and customer response. There is also increasing demand for higher performance from more sophisticated, interactive, immersive and lower‑latency computation and data storage users in fields like R&D (e.g. cutting‑edge academic research involving massive amount of data for intensive computing and simulation, requiring supercomputing and high‑density, high‑power data centres), gaming (utilising on‑demand servers and low‑latency connectivity for game development and delivery), finance (e‑banking, virtual banking, cryptocurrencies, virtual payment gateways requiring secure data protection), the metaverse (with the widespread adoption of AR & VR technologies) and quantum computing. These have become must‑haves since Covid-19, and they all require our data centre industry to evolve quickly and seamlessly to build up capacity and quality to meet these rapidly changing demands.

The fact that more than 90% of firms globally are expected to adopt a mix of on‑premises private clouds, public clouds and legacy systems to satisfy their own operational needs is going to reshape the data centre industry. This hybrid cloud infrastructure practice demands a high level of flexibility for data management, and high cybersecurity standards in order to ensure that classified data can be kept separate from public clouds. With Hong Kong being an international financial hub and home to a myriad of multinational firms, its data centre industry will undoubtedly be expected to satisfy these needs.

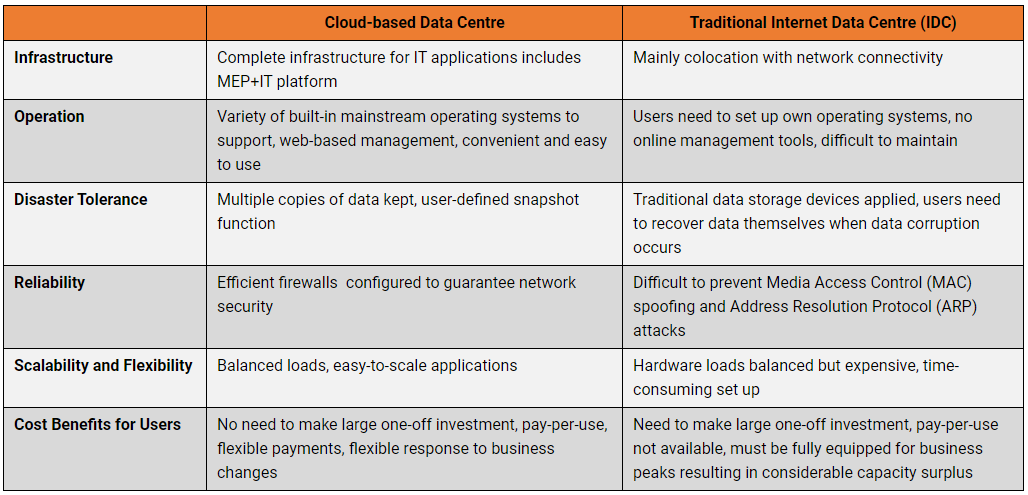

Given the ever‑changing nature of the business environment, data centres with cloud computing services have become a common cost‑effective choice for businesses to maintain and manage their business data, because of the ease with which they can be set up and operated, coupled with the back‑up convenience, reliability and flexibility of resource allocation that they provide. We do see a lot of virtual data centres offering IaaS (Infrastructure as a Service), PaaS (Platform as a Service) and SaaS (Software as a Service) as a set of strategies, so they can pitch to clients with different appetites for risk when it comes to data management, investing in buildings and maintaining their own data centres. However, the issue of how to maintain and enhance data transmission performance in terms of latency and secure protection when dealing with huge data flows will continue to challenge the development of the data centre industry.

Chan: It is estimated that by 2025, data centres will consume one-fifth of the world’s power. What is causing the majority of this demand for energy? Are there any technology breakthroughs which could tackle those 'pain points’ and help make data centres more sustainable?

Lee: Technological advances and data‑intensive computation have driven the increase in demand for data centre services, especially for high‑performance and high‑availability tasks. High‑density servers with high power consumption and heat generation have become more and more common, which in turn require more power for cooling and operation.

High‑density servers delivering round‑the‑clock access to applications and data require continuous cooling as the thousands of computers in the room generate a considerable amount of heat. Ventilation and cooling used to keep a data centre in operation at optimal temperature and humidity can therefore result in a high level of energy consumption. In order to reduce the environmental impact of the skyrocketing demand for data processing and storage, the data centre industry has been adopting different strategies to deliver sustainability.

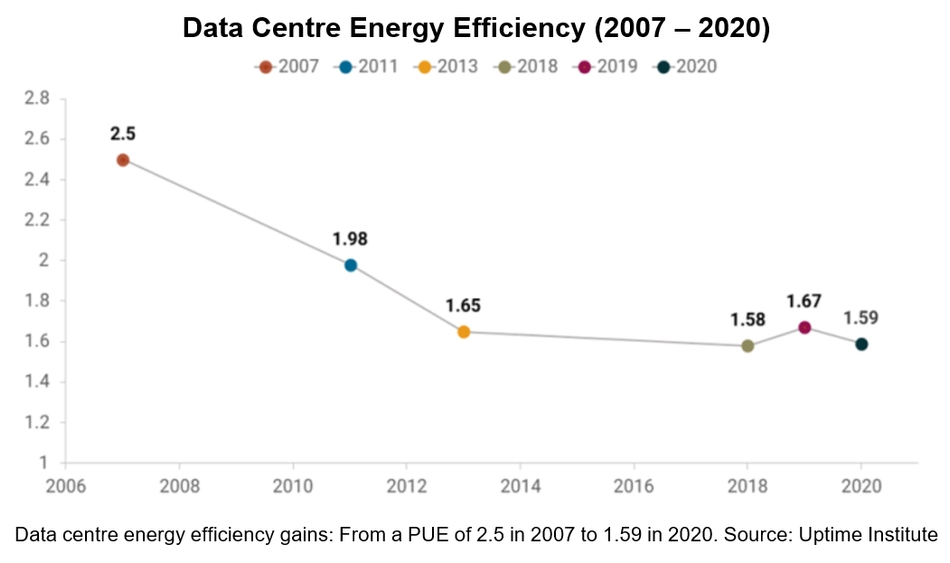

Power usage effectiveness (PUE), determined by dividing the total amount of power entering a data centre by the power used to run the equipment within it, is an indicator for measuring the energy efficiency of a data centre. To cope with ever‑increasing energy consumption, advanced energy‑efficient systems and technologies have been widely adopted by the data centre industry, to try to bring PUE as low as possible.

In recent years, we have seen data centre operators developing innovative ideas to power the servers, altering air flow and installing new AI‑ or IoT‑empowered cooling and monitoring systems to collect energy consumption data and optimise server usage or workload. At the same time, data centre petrol and server maintenance has been made much easier with the use of robotics, including 24/7 chatbots.

Meanwhile, the increasing adoption of mechanical ventilation and air conditioning (MVAC), air side management, hot & cold aisle containment, free cooling, oil‑free chillers, enclosure adaptive cooling (EAC) systems and data centre infrastructure management (DCIM) is providing better energy‑saving solutions to cooling monitoring and heat load distribution. Some large industry players also utilise natural resources to build green data centres. Examples include Microsoft’s underwater data centre, Alibaba’s data centre cooling using water from Qiandao Lake, and Tencent’s West Lab with indirect evaporative free cooling.

A breakthrough called immersion cooling was launched in September 2022 – the first of its kind in Hong Kong. Immersion cooling – a type of direct liquid cooling – is an innovative cooling solution that has significant advantages over traditional air‑cooling techniques. For facilities that feature extremely high‑density racks (typically over 30 kW), air cooling – no matter how new or optimised – is simply not sufficient to maintain the reliability of IT systems. Rack power requirements are reaching close to 20 kW in many facilities across the globe, and many organisations are looking to deploy racks with requirements of 50 kW or more. For such facilities, liquid cooling is not a choice, but a necessity.

Sealed in a unit and unaffected by vibration, humidity or airborne dust particles, the immersion cooling solution can allow up to a tenfold increase in computing density when compared to air‑cooled data centres. And, as liquid has higher thermal transfer properties than air, this no‑water no‑fan solution can result in a 45% lower carbon footprint than that of air‑cooled data centres, and a PUE of 1.09 or lower. By reducing space by 40%, immersion cooling allows cooling infrastructure CAPEX and OPEX savings of around 50% and 85%.

Thanks to its more efficient liquid‑to‑liquid heat transfer, a large proportion of the energy from heat recaptured under immersion cooling is ready for reuse, creating the possibility of energy neutrality by supplying heat and the application of renewable energy with a clearer timetable and roadmap.

Major companies have taken steps to introduce renewable energy to power their data centres. For example, Google now has three major renewable energy projects set to come online and begin feeding carbon‑free energy (CFE) into the grids that power its data centres in Quilicura in Chile, Hamina in Finland, and Fredericia in Denmark. With these projects in place, the company aims to achieve 24/7 CFE by 2030 and net zero emissions across all its operations and value chain by 2030.

In Hong Kong, in order to promote the retro‑commissioning and retro‑fitting of existing data centres and the design of new ones in accordance with the goals of energy conservation, energy efficiency and renewable energy, the Electrical and Mechanical Services Department (EMSD) has put into place two data centre‑related energy efficiency enhancement measures. These are the Building Energy Efficiency Ordinance (BEEO) (Cap. 610) and the Fresh Water Cooling Towers Scheme (FWCT Scheme) (《建築物能源效益條例》(第610章)及「淡水冷卻塔計劃」). The Buildings Department (BD) has also provided a set of Sustainable Building Design (SBD) guidelines and reference notes for gross floor area (GFA) concessions and the energy efficiency of buildings (《可持續建築設計指引》、總樓面面積寬免及樓宇能源效益等作業備考), while the BEAM Society Limited (BSL) has developed a BEAM Plus Data Centres & Green Data Centres Practice Guide.

The guide provides the best practices to help interested parties identify and implement

measures to improve data centre environmental performance. Source: BSL

When it comes to the private sector, Hong Kong boasts a flourishing green and sustainable finance market. The volume of green and sustainable debt arranged and issued in Hong Kong last year reached a record high at US$57bn, quadrupled the figure of 2021. Of this, green and sustainable bonds amounted to US$31.3bn, accounting for one‑third of those issued in the Asia market and making Hong Kong the leader in the region. Banks and financial institutions have been heavily promoting green finance, offering green loans and sustainability‑linked loans for businesses including data centre investors and operators. As part of Hong Kong’s development into a global, high‑quality voluntary carbon market, the data centre industry is hopeful of contributing more on the city’s progress to net zero.

Chan: What opportunity does the GBA bring to the industry? How can we leverage the resources in the GBA better?

Lee: Following the proposal to build eight national computing hubs and 10 national data centre clusters, the National Development and Reform Commission and other central departments have recently given the green light for the construction of a national computing hub in the GBA. They also called for the establishment of a Shaoguan data centre cluster in the Shaoguan High‑Tech Zone to address real‑time demand for computing power in Guangzhou, Shenzhen and other cities.

This is part of China’s Eastern Data and Western Computing (東數西算) strategy, which aims to meet computing demands from the eastern areas with computing resources in the western regions. Hong Kong, among many other contributions, is poised to support the computing network of the GBA by playing a pivotal role in “GBA Data and Hong Kong Computing (粵數港算)”.

To this end, we’ve launched a High‑Performance Computing (HPC) solution, OAsis, to empower complex data computing and simulation and prepare Hong Kong to become an international centre of innovative technology (國際創科中心). This will allow customers to combine the agile, pay‑per‑use cloud experience with fully managed HPC systems, which have been widely adopted as a tool for industry innovation and academic research, especially for projects involving massive data and large‑scale computing.

First, please LoginComment After ~