Sustainability for SMEs: Views from an ASEAN Start-up

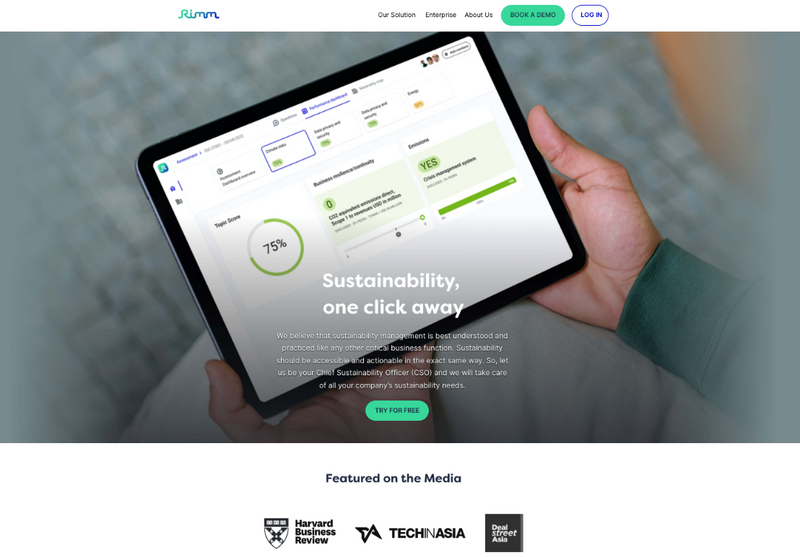

The global market has been taking sustainability seriously in recent years. More and more companies are, either voluntary or mandatory, taking steps to incorporate sustainability into their business. The Singapore start‑up RIMM Sustainability develops a single platform providing different types of sustainability management products and services for companies to assess their sustainability performance. While governments and regulators are putting pressure on large companies to start with ESG reporting, RIMM, on the contrary, focuses on SMEs. Yifei Xu, the Sustainability Insights Director of RIMM, shared with HKTDC Research her views on the opportunities and challenges for SMEs in their sustainability journey. She was particularly confident of the development of the sustainability market in Asia.

From reporting to analytics

RIMM develops a sustainability software‑as‑a‑service (SaaS) platform for companies of all sizes to assess their sustainability performance. It helps clients with sustainability at business, from assessment to analytics and reporting. Xu explained: “Throughout the process, we provide a complete suite of sustainability products and services to our clients. For example, we assist them in collecting the data required by different reporting standards.”

RIMM possesses a database of around 11,000 public companies’ sustainability data collected from public sources, including sustainability reports and company websites. It then benchmarks the clients’ performance against peers in the same industry. After the assessment, RIMM provides analytics and reports for its clients, including scoring, benchmarking, case studies, strategies and recommendations, and even topic‑focused solutions around carbon emissions, employee relations, human capital management, etc. Xu cited as an example that RIMM developed a carbon calculator for its client to convert energy consumption and linked its client to different solution partners through their marketplace. She said: “Our work facilitates the sustainability data disclosure and increases transparency.”

Targeting SMEs

At present, sustainability could be more relevant to large companies. Not only they have to fulfil the compliance requirements, but they also have more resources and capacity. However, Xu also found rising needs and interests from SMEs. She said: “Sustainability could bring financial benefits to SMEs in particular, considering the increasing number of green funds and sustainability financing opportunities in the market.” For example, an alternative energy company in India successfully got the approval of a funding worth US$ 10 million using RIMM’s SDGs Impact Tracker, a tool aiming to measure companies’ business impacts across the 17 SDGs. Secondly, MNCs are taking sustainability seriously. SMEs need to fulfil the requirements and criteria to be eligible to be their supplier. Thirdly, SMEs may wish to publish the sustainability reports externally for marketing and branding.

Nevertheless, considering that SMEs are not under compliance pressure, Xu believed more efforts are needed to encourage them to kick start their sustainability journey. She added: “SMEs may find it difficult to understand the concepts and terminology of sustainable development, not to mention the costly services in the market.”

With a mission to simplify and democratize sustainability management for companies, especially for SMEs, RIMM is trying to make its products and services more affordable and accessible to those companies. It works with different partners, such as fund managers, investment firms, insurance companies and manufacturing MNCs, to leverage on their client portfolio to reach SMEs. Xu said: "For example, we collaborated with some of the largest automotive companies in Japan on a supply chain program, in which we tailored our products and services for our partners in accordance with their requirements to suppliers who are most likely SMEs. All the potential suppliers are then required to take an assessment on their sustainability performance. These exercises push those SMEs to take actions to improve sustainability.”

A diversified market

Currently, RIMM has offices in Singapore, Tokyo and London. With her experience, Xu said: “Within Asia, companies can be very different. We tried to expand our footprint to other markets, such as Indonesia, Malaysia, India and China, but unfortunately the expansion didn’t go well. Instead, in more developed economies, like Singapore, Japan and Hong Kong, we clearly found uptick in demand for our services. Not only because of the higher development levels, but also the stronger motivation of local governments.”

Talking about Hong Kong, Xu was positive about the market prospects, but she also pointed out the challenges in operations. First, RIMM will need to overcome the language difference and provide Chinese reports to SMEs in Hong Kong. In addition, RIMM is required to comply with the data security regulations in Mainland China and store the data locally for its Chinese clients, in which RIMM does not have the capacity to fulfil the requirements for the time being.

Comparing these markets, Xu highlighted that Hong Kong’s sustainability standard is one of the most stringent. She explained: “Major stock exchanges around Asia including Singapore, Malaysia, allow listed companies to choose any of the international ESG reporting standards such as Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB) and International Integrated Reporting Council (IIRC), etc. However, the Hong Kong Stock Exchange developed its own ESG Reporting Guide, with much more key performance indicators companies are required to disclose.”

Going forward

Nevertheless, the market is changing quickly. For example, the Singapore Stock Exchange requires issuers to provide climate‑related reporting based on recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) commencing 2022. She said: “I believe the sustainability requirements and regulations will become more stringent in many markets, especially in developed economies, where people are more knowledgeable about sustainability and therefore more willing to disclose. Although sustainability reporting is voluntary, it will become mandatory in the future, implying more challenges for SMEs.”

Xu believed Asia, with a high concentration of SMEs, has a lot of potential for the sustainability market. The relatively low data disclosure level in the region means that there are many opportunities for RIMM to improve data transparency and data quality. Moreover, the larger government role in Asia could speed up the formulation of policies and regulations around sustainability, which encourage SMEs to compete on their sustainability performance. Xu remarked: “Large companies are driving sustainability because they have the resources and capacity. We should also work closely with SMEs to make the real impact.”

First, please LoginComment After ~