The Securities and Exchange Commission, Thailand

Our Roles

The capital market is the main mechanisms that efficiently mobilize, allocate, and monitor the utilization of the economic resources. The capital market links and transfers capital between businesses that need funding both in the public and private sectors with the saving parties who want to invest. This has effectively increased a diversity of alternatives in fund mobilizing and investments. The benefits of capital market are maximized through the contributions to the development of the country's potential and competitiveness, supporting business growth, diversifying risks and creating a balanced financial system.

Currently, the Thai capital market has an aggregate value greater than the country GDP, creating a large number of employments on the parts of business operators, professionals, and listed companies, and become important tax units that create sizable revenue to the country.

As the Thai capital market has been developed to become increasingly efficient and significant sources of financing, they have, in parallel, increased contributions to the country's economic growth and social development. The SEC* has set our vision as follows:

“The SEC is ready to embrace changes and develops a sustainable capital market

and economy for the benefit of all stakeholders"

Our mission is:

“To assure conducive environment for a fair, efficient, dynamic and inclusive capital market"

____________________________

* The SEC represents the whole organization of the SEC with three tiers of authority : The SEC Board primarily responsible for policy formulation for market promotion and development ; the Capital Market Supervisory Board issuing rules and regulations; and the SEC Office executing the supervisory policy to ensure compliance with and enforcement of the rules and regulations.

To enable stakeholders to realize what they can expect from the work of the SEC and to benefit from utilizing capital market with confidence, we have prepared a Statement of Intent, declaring our intentions and commitments to appropriately responds to the needs of the public and stakeholders in supervising and developing a sustainable capital market, and to efficiently and effectively achieve the national missions within the scope of assigned authority and under the related laws.

SEC Working Principles

Code of Governance

Auditing Mechanism and Balances

SEC Code of Ethics

SEC Anti-Corruption Policy

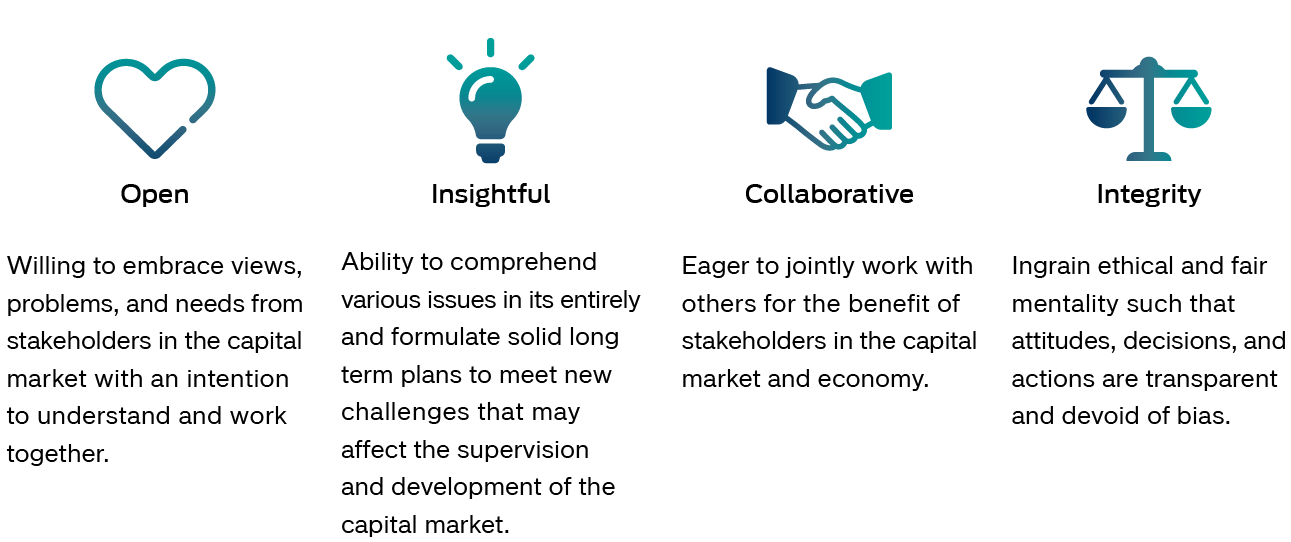

The SEC values

As an agency with missions for promoting, developing and supervising the capital market, the SEC strives to ensure transparency and credibility of our own operation as well as fairness to all stakeholders. The SEC Board seriously focuses on adopting the principle of a good governance in the organization. In this connection, a Code of Governance was formulated to be applied for the SEC Board, the Capital Market Supervisory Board, and the SEC Office. The SEC Code of Governance was prepared as required by law and equivalent to industries and international standards. This is to ensure that the governance standards of the SEC are rigorous, not lower than the international standards, and not lower than the regulated entities under our own supervision. The governance framework was approved by the SEC Board on October 1, 2007. It has been reviewed periodically since then to ensure appropriateness, topical consistency and compliance with relevant laws.

The SEC Code of Governance imposed on board members, executives and staff covers the following areas:

-

1. Accountability

-

2. Responsibility

-

3. Equitable Treatment and Participation

-

4. Disclosure and Transparency

-

5. Internal Control and Internal

-

6. Value Creation by Enhancing Market Competitiveness

-

7. Code of Conduct and Code of Ethics

The Board-Level Code of Governance specifies the following areas:

-

1. Board Composition and Structure, for instance, nomination procedure, term of office and sub-committee appointment;

-

2. Board Policies, for instance, code of ethics, conflicts of interest and equitable treatment of stakeholders; and

-

3. Board Practices, for instance, setting of directions, policies, goals and strategies, supervision and monitoring of the SEC's operation, and board-level evaluation

The SEC Office Code of Governance specifies the following requirements:

-

1. Legal compliance

-

2. Independence, transparency, fairness and accountability

-

3. Resource sufficiency

-

4. Reporting and disclosure of information

-

5. Standards of practice, internal control and internal audit

-

6. Risk management

-

7. Complaint handling

-

8. Operating guidelines

Auditing Mechanism and Balances

The SEC Board is empowered to appoint the Audit Committee to reinforce transparency, fairness and accountability of the SEC. This checks and balances structure helps to establish an efficient internal control.

Subcommittee on Governance and Remuneration Sub-committee (Office term of two years)

The Subcommittee has a duty to propose policies and workplans for developing organizational governance, as well as frameworks for recruitment of officers, remuneration determination, and evaluate the performance of the Board, the Capital Market Supervisory Board, the SEC office, the subcommittee and the Secretary-General. The Governance and Remuneration Sub-Committee comprises three members.

Currently, Subcommitte on Governance and Remuneration Sub-committee comprises:

-

1. Mr. Prasan Chuaphanich Chairman

-

2. Mr. Viput Ongsakul Member

-

3. Mrs. Nuntawan Sakuntanaga Member

The SEC Code of Ethics provides guidelines for current and former employees with the highest priority on the organizational interest. The code also specifies appropriate conducts in protection of the SEC reputations, divided into two areas as follows:

-

1. Staff Code of Ethics consists of guidelines for handling conflicts of interest, for example, prohibiting staff from trading stocks or accepting assets or other benefits with value exceeding those traditionally acceptable from persons or juristic persons who have stakes in the SEC operation. This is to ensure that the SEC operation is reliable, transparent and fair to all stakeholders.

-

2. Ethic, Requirements and Procedures to Usage of Computers and Communication System of the SEC Office consists of guidelines for IT security protection, storage and retrieval, prohibition of access to staffs' accounts and passwords by other persons, prohibition of social network sign-up or contact via SEC email addresses without prior approval of the SEC Office, etc.

To assure that the SEC carries out the duties with integrity, transparency and corruption-free, all board members, executives, and staff are obligated to comply with the policy of corruption-free organization.

First, please LoginComment After ~