CSSF

The Commission de Surveillance du Secteur Financier (CSSF) is the supervisory authority of the Luxembourg financial sector. Its duties and its field of competence are provided for in the organic Law of 23 December 1998.

Mission statement

The Commission de Surveillance du Secteur Financier (CSSF) performs its duties of prudential supervision and supervision of the markets for the purposes of ensuring the safety and soundness of the financial sector, solely in the public interest. Within the limits of its remit, it ensures that the authorised entities and the issuers are complying with the regulations applicable to them, including those aiming to ensure the protection of the financial consumers and the prevention of the use of the financial sector for the purposes of money laundering or terrorist financing. The CSSF represents Luxembourg in the area of European and international supervision.

In pursuing its objectives, the CSSF applies a prudential approach in line with the international standards, in accordance with the principle of proportionality. This approach is implemented in a professional manner, thereby ensuring an independent, forward-looking and risk-based supervision.

The CSSF is transparent and fosters effective communication with the stakeholders of the financial sector while fully complying with the professional secrecy requirements. It considers integrity and accountability to be of utmost importance and delivers on its commitment and adapts to reach its objectives. The CSSF is committed to good governance and to performing its tasks with efficiency, in a spirit of internal cooperation as well as at national, European and international level.

Prudential supervision

Supervised entities

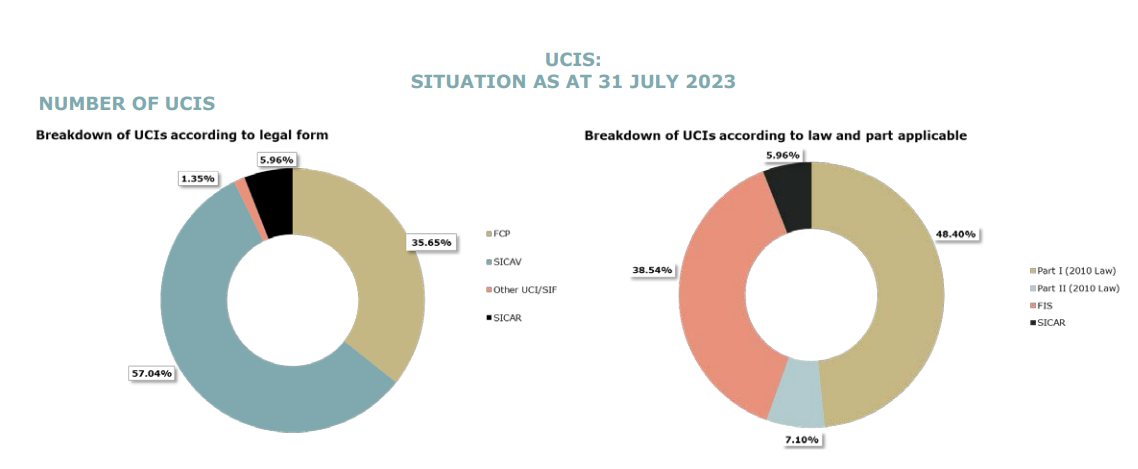

The CSSF is the competent authority of the prudential supervision of credit institutions, professionals of the financial sector (investment firms, specialised PFS, support PFS), management companies, alternative investment fund managers, undertakings for collective investment, pension funds (SEPCAV and ASSEP), SICARs, authorised securitisation undertakings, fiduciary-representatives having dealings with a securitisation undertaking, regulated markets as well as their operators, multilateral trading facilities, payment institutions and electronic money institutions.

Supervision of markets in financial instruments, including their operators

The CSSF is, within the limits of its statutory powers, in charge of promoting transparency, simplicity and fairness on the markets of financial products and services.

Resolution

The CSSF is the national resolution authority and performs the tasks arising from Directive 2014/59/EU establishing a framework for the recovery and resolution of credit institutions and investment firms and Regulation (EU) No 806/2014 establishing uniform rules and a uniform procedure for the resolution of credit institutions and certain investment firms in the framework of a Single Resolution Mechanism and a Single Resolution Fund.

Control regarding the fight against money laundering and terrorist financing

The CSSF is in charge of ensuring compliance with the professional obligations regarding the fight against money laundering and terrorist financing by all the persons supervised, authorised or registered by it.

Financial consumer protection

The CSSF is the competent authority to ensure compliance by the supervised professionals with the laws protecting financial consumers.

Public oversight of the audit profession

The CSSF is in charge of

granting the title of réviseur d’entreprises and cabinet de révision, of their approval and registration;

adopting auditing standards and standards on professional ethics and internal quality control of cabinets de revision agréés (approved audit firms);

continuing education;

implementing a quality assurance system to which all réviseurs d’entreprises agréés (approved statutory auditors) and approved audit firms carrying out statutory audits and any other assignments which are reserved to them by the Law concerning the audit profession are subject to.

Sanctions

The CSSF has a whole range of significant measures to act against persons subject to its supervision that would violate the applicable regulations relating to the financial sector or that would not comply with the professional obligations imposed on them.

National, European and international cooperation

The CSSF cooperates with the Banque Centrale du Luxembourg, the European supervisory authorities and the other supervisory authorities and resolution authorities at the European and international level.

Contact

Switchboard

(+352) 26 251 - 1

(+352) 26 251 - 2601

Address

Postal address (P&T):

L-2991 Luxembourg

Address (head office):

283. route d’Arlon

L-1150 Luxembourg

First, please LoginComment After ~